On June 1st, Senior Accountant Jake Shockley and Client Service Manager Catherine Kruse presented on the IRS homepage and why it might be time to embrace the options that the IRS offers. While many taxpayers feel very strongly against being on their radar, the new technology that “The Service” offers is definitely an advantage in the long run. Don’t miss their next webinars on August 3rd and September 7th on submitting a power of attorney through the IRS site and making an estimated tax payment!

This Wednesday, second quarter estimated tax payments are due, and if you haven’t made your payment yet, it’s not too late to do so online! Paying your estimates and other tax payments online is a safer, more reliable option for making your payments. Furthermore, if you sign up for an account with the IRS, you will be able to make your payments through the site and you will also be able to track what the IRS has on file for you. This blog post walks you through the payment options and what to expect.

Though you can’t make your state tax payments using the IRS site, most states do have the option to pay online through a department of revenue site. For instance, you can make payments to Missouri using this link: https://dor.mo.gov/taxation/individual/pay-online.html. If you need assistance finding the right link for your state, give HKA a call and we can verify and send you the correct link to pay on.

When making the payment, you will want to be sure that you select the following options correctly:

- Reason for Payment: Balance Due, Estimated Tax, or Amended Return are the most common

- Apply Payment To: This is the tax form that you would normally be mailing in. If it is your personal tax return or amendment, you will select 1040. If it is an estimate, you should choose 1040-ES.

- Tax Period for Payment: This should be 2021 if you are making a tax payment with your return and 2022 if you are making an estimated payment.

To begin the process making a payment with the IRS, you can either go directly to your account with the IRS or visit this page: https://www.irs.gov/payments.

If you have an account with the IRS, you can click on “Go to Your Account” and along with the payment options, you will be able to see any account balance that the IRS has on record, a payment plan if you have one, other payments that you’ve made, and whether any payments are pending or scheduled.

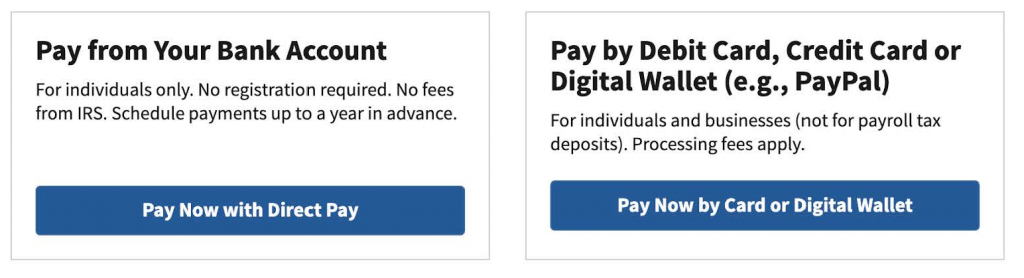

If you do not have an account with the IRS and would like to bypass the option for now, you can click on one of the multiple options below:

Pay from Your Bank Account or Pay by Debit Card, Credit Card or Digital Wallet: You will notice that the IRS clearly lays out which of these options allows you to make a free payment, and there are certainly benefits to each. To pay from your bank account, you do need your bank routing and account number, while paying with a credit card or digital wallet such as Paypal can be a little more convenient. If you do decide to pay by credit card, be sure to read the different fee structures that the vendors offer to you. There will be multiple options and each will have a different structure.

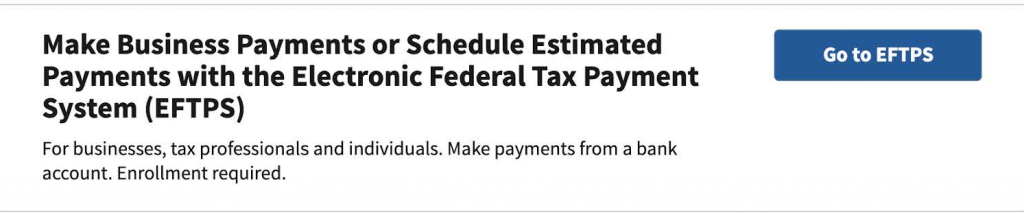

The EFTPS system requires enrollment, but can be a good option if you would like a consistent way to make your payments in the future. You won’t be able to sign up for this if you need to make the payment that day, but can certainly be a good long-term plan. This system has been around longer than some of the other options and offers the ability to pay up to a year in advance, as well as a hotline for questions. You can read more about the system here: https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system.

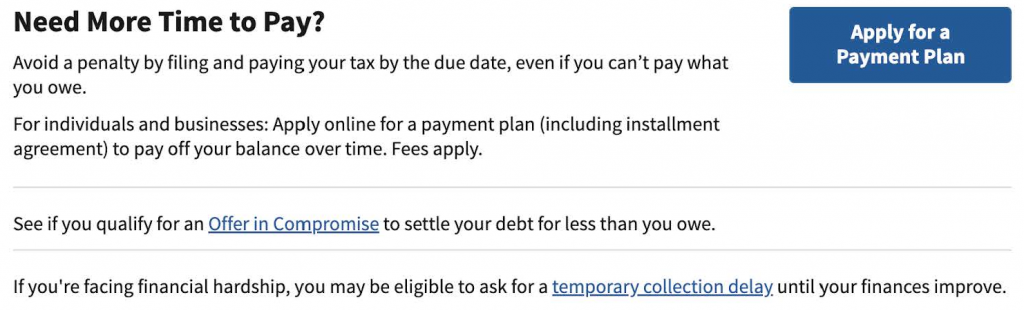

The “Need More Time to Pay” section of the page allows you to set a payment plan, which is a great option if you need to make a payment, but just can’t pay in full. There are some other options, such as an Offer and Compromise or temporary collection delay also linked to the site. If this is something that you are worried about, please don’t hesitate to call HKA and we can work with you on the different options and what might be best for your particular situation.

Finally, the site even offers “normal” ways to make your payments with an informational video on where to go from here. Please don’t hesitate to call HKA if you need to make a payment and are not sure how to proceed!